Q4 2016 – “And the Pendulum Swings…”

Q4 2016 – “And the Pendulum Swings…”

The past year will be remembered as a year of surprises whose consequences will be felt throughout 2017 and beyond. And while the nationalism movement has seemingly been oscillating for several years, the pendulum came to a standstill and started to swing the other way this past June when the United Kingdom voted to leave the European Union. The antiestablishment momentum continued into November when Donald Trump caught the world off-guard and became the 45th President of the United States.

While many pundits were calling for a market crash on the night it became apparent that Donald Trump had clinched the electoral votes needed to make him the President-elect, the market ignited with exuberance and finished the year with a total return of 11.96% measured by the S&P 500 Index.

The capital markets had their share of challenges throughout the year. After finishing 2015 with a relatively lackluster return of 1.38% for the S&P 500, the first month and a half of 2016 appeared to be the end of the current bull market which began in March of 2009. By mid-February the S&P 500 had dropped by about 15% from the beginning of the year and this decline combined with skittishness of the global economy led the Federal Reserve to take a more cautious stance with their intentions of increasing U.S. interest rates throughout 2016.

Recall that in December 2015 the Federal Reserve forecasted four rate increases throughout the year. In short order, the market responded favorably to the prospect of rates staying lower for longer and distressed debt which had previously sold off, particularly bonds issued by energy companies, returned to favor as investors sought yield and bid up such speculative bonds. As a result, the BofA ML High Yield Master II Index, a commonly used benchmark measuring the performance of lower quality, non-investment grade bonds, surged 17.49% on the year.

Meanwhile within the equity markets, 2016 was a year that favored value stocks over growth stocks by a wide margin. The Russell 3000 Value Index advanced 18.40% for the year versus a 7.39% gain for the Russell 3000 Growth Index. Value stocks are traditionally characterized as those with lower price-to-earnings ratios, lower price-to-book ratios, and higher dividend yields while growth stocks typically have higher growth rates, greater earnings potential and consequently higher valuation measures.

Most of the disparity between the value and growth benchmarks can be attributed to the strong performance and larger weight of the energy sector in the value index. With the prospect of a more balanced supply and demand crude oil market and OPEC’s production cut promises at the end of 2016, energy was one of the best performing sectors of the market. Another larger value weighted index component, basic materials, was the strongest performing sector of the year, with steel companies leading the charge as clear beneficiaries of a Trump Administration.

With the swing in the pendulum, we see a number of tailwinds and headwinds for investors in 2017 and beyond. The tailwinds are quite obvious even without any passed legislation as the new administration will be noticeably more business-friendly. Progrowth policies and other reforms outlined by President-elect Trump centering around corporate tax reform and eliminating much of the regulation enacted over the past several years has been well received by many industries. Additionally, permitting U.S. companies to repatriate cash held overseas with minimal or no tax consequences could allow nearly $2.5 trillion to return to the U.S. with the potential to be invested back into the U.S. economy.

Another prospective major tailwind for the U.S. economy is President-elect Trump’s proposed $550 billion infrastructure investment plan to improve the transportation network throughout the U.S. All of these initiatives are powerful forces encouraging businesses to spend and invest, but they are major secular changes that won’t happen overnight and could take years to unfold. Even if individual and corporate tax cuts are passed this year, they aren’t likely to take effect until 2018.

As we have brought up numerous times throughout the years, corporate tax reform is imperative to help U.S. companies compete in the global marketplace. When evaluating potential government action, it is always prudent to distinguish between intentions and reality, but assuming the tax cuts become a reality, the business expansionary cycle should continue even though by economic standards it is in the late stages of a normal historical cycle as we will be annualizing its eighth year in March.

In addition to potential governmental action, an additional tailwind that is being provided to the U.S. economy is the significant increase in consumer confidence post-election. During the last week of December, the Conference Board’s Consumer Confidence Index climbed to 113.7, the highest in 9 years, driven primarily by hopes for the future. Increased confidence typically means increased future consumer spending, which in addition to the increased business confidence could propel the U.S. economy to achieve the 4% Gross Domestic Product growth promised by President-elect Trump on the campaign trail.

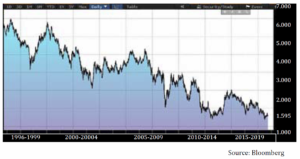

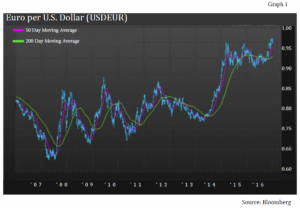

While things look extremely positive for Main Street, there are a number of headwinds that we are monitoring. One significant headwind is the stronger U.S. dollar. (see Graph 1) Since mid-2014, the dollar is up nearly 25% with its latest surge coming after the U.S. election (its highest level in over 13 years). If the dollar continues to strengthen, it could have long-lived economic consequences creating risks for U.S. manufacturing activity, corporate profits, exporters, commodity producers, and foreign dollar-denominated debt issuers. While Japan and Germany are among the countries benefiting from a stronger dollar as their exports become cheaper compared to U.S. goods, the stronger dollar is less welcomed in emerging markets, as it puts pressure on their central banks to raise interest rates to prevent further depreciation of their currency and to contain inflation. Central banks throughout the world are walking a fine line with the process of normalizing interest rates against the ability of heavily indebted economies to absorb higher interest costs.

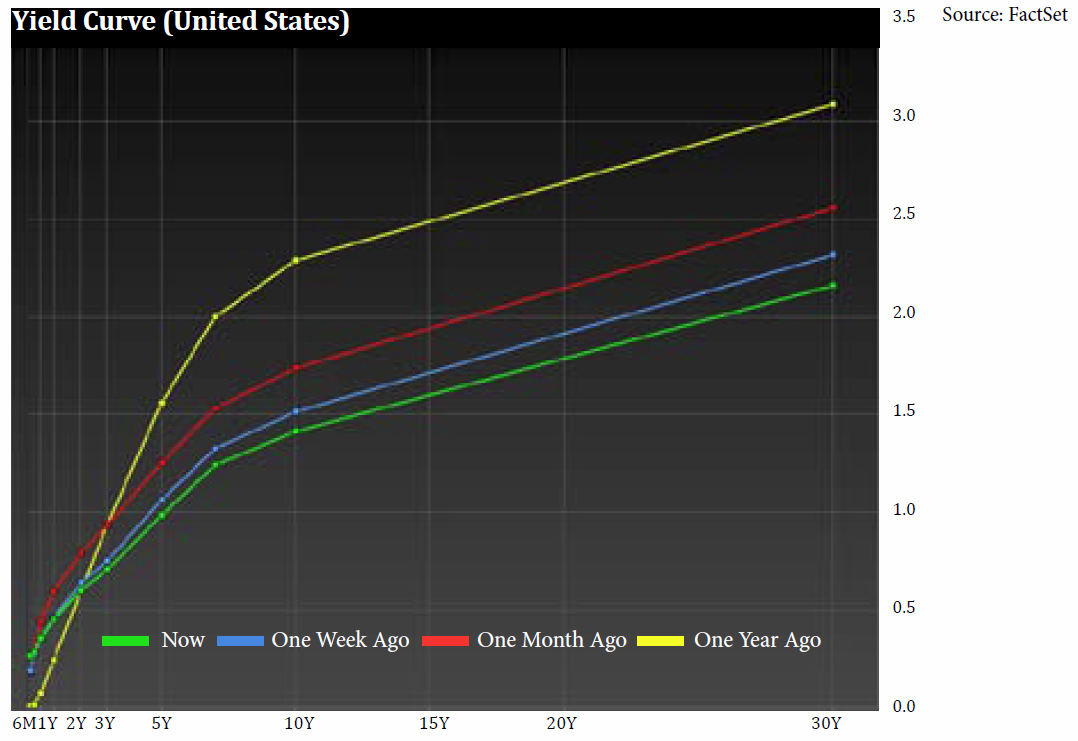

One of the primary drivers of U.S. dollar is the prospect of higher interest rates domestically. We believe rate increases in 2017 will likely be modest at best, with the Fed projected to raise rates three times throughout the year. Since the rate hike in December 2015, the Fed was very circumspect with rate increases in 2016 only increasing short-term interest rates by 25 basis points this past December. This was only the second time that the Fed Funds rate has been increased since 2006. Nonetheless, given the reflationary and pro-growth policy platform of the Trump Administration, it is widely anticipated that the Fed will pick up the pace of rate increases as long as the U.S. economy gains momentum. While the prospects of higher rates will be well received by savers, it will likely be years before rates are back to “normalized” levels from a historical perspective. Regardless, when comparing Germany’s 10-year Bund yield of 0.20% versus the U.S. 10-year Treasury yield of 2.45%, foreign yield seekers are buying dollars to obtain the higher yields that U.S. bonds provide versus similarly-rated foreign securities.

Another headwind worth noting is China. While there are a significant number of unknowns with President-elect Trump and his potential policies, he has been quite vocal of his disdain for China’s unfair trade practices in world markets. This will be a key hotspot for investors to monitor throughout 2017. Even though the bantering back and forth on unfair trade practices seems to occupy media headlines, internally China could be dealing with a more pressing issue of its large quantity of non-performing loans. While China’s officials estimate its non-performing loans to be about 1.5% of outstanding loans, some independent analysts predict it could be as high as 22%. Regardless of the exact level, the best scenario for mitigating their potential debt problem is a wave of economic growth in China. But the headwind provided by President-elect Trump clearly could hamper the world’s second largest economy in achieving this seemingly daunting goal. This is particularly true in an age when discussion regarding trade is peppered with protectionism, nationalism, tariffs, and renegotiating trade agreements. None-the-less China will continue to attempt to drive domestic consumption as it becomes less competitive in the world’s platform on labor costs than it was a decade ago.

Europe’s nationalist movement that started with the UK vote in 2016 could continue into 2017 with three key national elections set to take place in Germany, France, and Netherlands. Regardless of the outcome of those elections, the pendulum that is already in motion will provide headwinds and tailwinds for U.S. investors throughout 2017 and beyond.

As professional investors, we take an agnostic view of politics and rely on secular growth trends that provide investment opportunities regardless of which political party has control. And on that basis, we see plenty of growth opportunities for investors both in the U.S. and abroad.