Q3 2021 – “Interest Rates and National Debt Continue to Weigh on Markets”

The stock market was essentially flat in the 3rd quarter with the S&P 500 rising just 0.58%; bond returns were slightly negative. The quarter started strong as corporate 2Q earnings reports pleased investors, by and large, with near-record numbers of reporting companies beating expectations, thus prompting positive earnings revisions. However, the market sold off hard in September as economic, political, and geopolitical tensions ramped up, impacting both stocks and bonds.

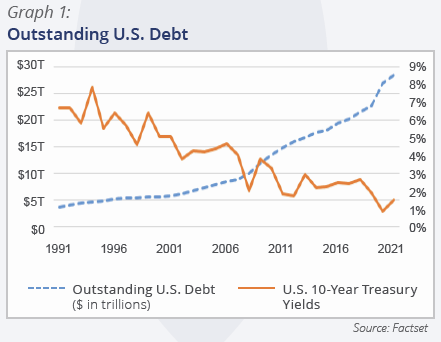

On the economic front, inflationary fears have gripped the market, which has driven interest rates back up. The 10-year Treasury yield is now almost 1.6%, after a rally from the early part of the 2nd quarter, bottoming at below 1.2% in early August (the all-time low was 0.5% during the summer of 2020). This move in rates is consistent with the expectations laid out in last quarter’s newsletter. The market is beginning to adjust to anticipated lower (but still historically high) levels of accommodation from the Federal Reserve (the “Fed”) on monetary policy and the potential impact of continued debt issuance by the Treasury to fund increased government expenditures.

On the monetary front, the Fed has signaled its willingness to soon taper the $120 billion in monthly bond purchases it has been making ($80 billion in U.S. Treasuries and $40 billion in mortgage related securities), likely before the end of the year. As detailed last quarter, these purchases add liquidity into the financial system because the dollars used to pay for the bonds remains in the economy, spurring economic growth. This effect will cease when tapering occurs, thus eliminating a significant source of demand for bonds, with higher rates possible if other investors do not pick up the slack (interest rates and bond prices are inversely related). The Fed has been clear to differentiate between bond purchase tapering (they will likely start gradually, by reducing the monthly amount by less than 15% initially, hoping to end by the end of next year) and the short-term Federal Funds Rate. The Fed currently does not expect to change its 0-0.25% target before 2023.

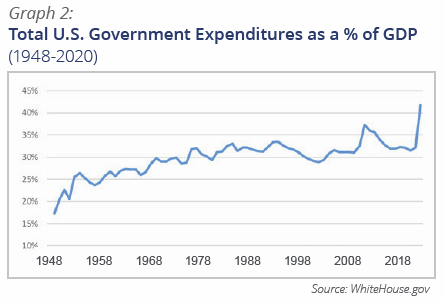

Fiscally, Congress is still trying to pass a $1.2 trillion bipartisan infrastructure bill, and battling over President Biden’s “social infrastructure” initiative, which is now expected to be $1.5-$2.5 trillion. The market has reacted harshly to the uncertainty over the amount of spending and how it will be paid for, especially with respect to potentially looming higher corporate and capital gains taxes, which could prove a headwind for corporate earnings and consumer spending and so a catalyst for selling securities.

The debt ceiling has become political theater, but we expect it will be extended one way or another before catastrophic impact, following the recent two month extension through December, with attendant risk of political brinksmanship prompting market volatility. It is in this context that the market is weighing the benefits of continuing excess spending by the government through these on-the-table bills against the likelihood that it will be the last out-sized spending bills to pass for a while, as looming mid-term elections will likely preclude another major spending bill from passage.

We acknowledge that these conditions have existed for years, with debt outstanding and the government’s total spending as a percent of Gross Domestic Product (GDP) rising as interest rates have gone down. But with a now $28 trillion plus of debt, rate increases threaten to crowd out other spending.

Trade tensions between the U.S. and China and China’s escalating actions towards Taiwan has also been a source of pressure on the market. Finally, and perhaps most threateningly for prospective corporate profits, high commodity costs and related supply chain pressures, as the world tries to recover from the pandemic-induced slowdown, have given investors pause about how robust corporate profits are likely to be and what multiple should be paid for them. This tightness is especially acute for energy supplies, including electricity feedstock supplies, which is a particular concern as we move towards the winter in the northern hemisphere. Biden Administration prohibitions and restrictions on drilling activity in the U.S. and OPEC’s recent unwillingness to increase production has also contributed to driving oil and natural gas prices to multi-year highs. Given energy prices are used to make and ship a myriad of products, the inflationary impact of higher commodity prices is clear.

We expect interest rates to continue to move upwards in the coming months, believing that it will take more time for the supply chain issues and commodity markets to normalize, thus keeping upward pressure on prices and reducing the attractiveness of bonds, since the fixed cash flows will be reduced in real (i.e., inflation adjusted) terms. We currently do not expect the Fed to raise the Federal Funds Rate during 2022, however this view could change if employment trends pick up next year.

Though it will likely be the last major spending bills before the mid-term elections, we do expect it to accrue benefit to the economy given their sizes, and we think there is still significant pent-up demand, especially for travel and hospitality, which we have exposure to. But this is offset by the elimination of some of the pandemic-inspired special social safety nets, such as enhanced unemployment benefits. Ultimately, we will be carefully gauging how expected higher prices will impact demand and for how long and whether it might lead to changed purchasing habits that will impact the companies we are invested in.

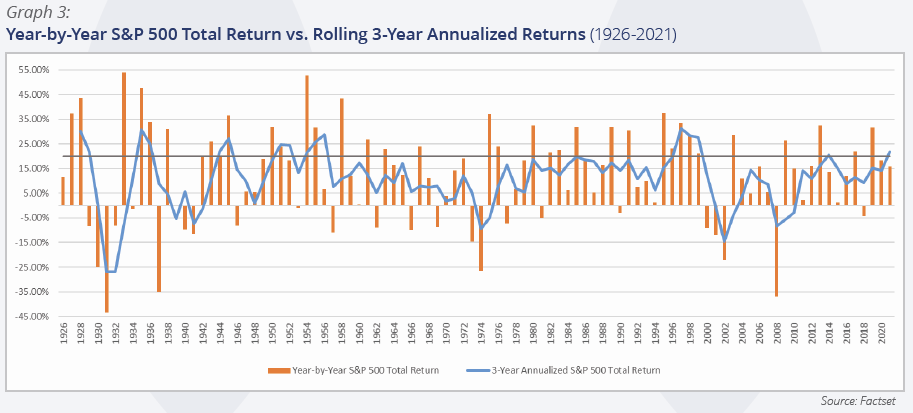

Putting it all together, we see the potential for higher equity prices in the near-term, but we believe the market will generate lower overall returns next year compared to the past few abnormally high-return years we have enjoyed, and we will be striving to protect recent outsized returns. Graph 3 shows how 3-year period annualized returns are rarely above 20% (the periods where the blue line is above the horizontal black line on the chart); this is where the 2019-2021 period will end up if 4th quarter S&P 500 returns are merely flat. The chart shows how such outsized annualized returns over 3-year periods have frequently been followed by negative return years within 12-24 months, including some of the larger corrections on record.

This makes us more cautious than we were last year entering the 4th quarter and even more biased towards higher quality companies. Ultimately, we believe our long-term focus on companies with strong balance sheets that sell in-demand products and services, and which have the potential to succeed through full economic cycles, should perform well in this anticipated environment. Such companies should be able to better pass on higher costs in the form of higher end prices to customers to maintain margins. We expect the trend of increased share buybacks and dividend payments to investors to continue, perhaps to the detriment of capital spending until prices moderate more, needed inputs are more readily available, and persistent demand coming out of the pandemic is in evidence.

At KCM, we remain vigilant in monitoring the economy and the companies we are invested in on behalf of our clients, whom we thank again for their trust and support. We extend our best wishes for a wonderful upcoming holiday season.

KCM Portfolio Management Team