Q3 2019 – “U.S. – China Trade War Continues to Lead Market Discussions”

For all of the excitement that transpired in the 3rd quarter, it was remarkable that the U.S. equity market eked out a modest increase of 1.70% for the quarter, as measured by the S&P 500 Index (total return, including dividends). This result was just enough to help stocks hold on to their biggest year-to-date gains since 1997. Additionally, with interest rates trending downwards since the beginning of the year, high yield bonds (as measured by the ICE BofAML U.S. High Yield Index) have generated robust returns year-to-date of 11.53% as investors searched for yield further out on the risk spectrum. High yield bonds produced a return of 1.41% for the quarter – a level similar to the S&P 500. While the absolute returns continue to help extend the longest bull market on record, the rapidly-changing environment continues to increase the volatility in the market to whatever the flavor of the day is — growth or value, risk on or risk off, international exposure vs U.S. exposure, etc.

We often describe market risk to clients by using the analogy of climbing a tree. When you are on the ground looking up, you see a vast amount of opportunity and limbs that should be easy to hold, elements that are far from your mind regarding risk because there is little downside as you start the climbing endeavor. This scenario is relatable to the time period of 2009, when risk had been washed out of the system via a reset of equity prices, and central banks throughout the world made a concerted effort to stimulate the world’s economies at a level never experienced before. However, as you get higher in the tree, you start to become more aware of your surroundings and doubts start to enter into your mind regarding risk that you didn’t think about previously while on the ground. You become more aware of the data points of the day, because being high in the tree, there is a real consequence to a misstep or miscalculation.

The latter describes the investing environment we are in today with an abundance of data points impacting the marketplace. Some of the news has been influencing the marketplace for years (Brexit, Central Banks’ policies, trade disputes) but others have reared their heads recently.

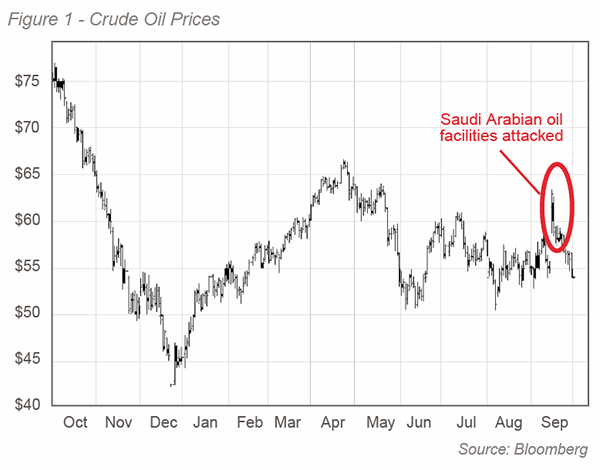

One of the relatively new events that influenced the market temporarily was the recent attack on the Saudi Arabian oil facilities, which crippled the world’s largest oil exporter, knocking out 5% of the global supply. Prior to any time before this, if 5% of the world’s oil production were taken offline, there would have been a lasting impact on crude prices, and more direct impact to the consumer at the gasoline pump. That wasn’t the case with this disruption, as crude prices quickly retreated back to pre-attack levels following the initial price spike (illustrated in the chart below).

While a portion of this can be attributed to fears of a slowing global economy, record crude oil storage levels, and reassurances by the Saudis that production will be back online fairly quickly, the most significant factor is the changing landscape in oil production and America’s role in cushioning the world markets from geopolitical supply shocks.

U.S. oil production is on track to reach an average of 12.2 million barrels a day this year, up from last year’s average of 11 million barrels per day. To put this increase into context, in 2009 the U.S. was producing approximately 5 million barrels per day after decades of declining oil production from its peak in early 1970s. The uncertainty will remain in the Middle East, but its geopolitical impact to the United States has been minimized by U.S. exploration and production success over the past decade. Nonetheless, there are economies that could be severely impacted by oil production disruptions in the Middle East, most notably China.

China, while no longer the fastest growing oil consumer in the world (that distinction now belongs to India), is still the largest single importer of oil in the world today, importing more than 9 million barrels of oil per day in 2018. The Middle East is the largest collective source of Chinese oil imports, accounting for over 45% of its supply from nine Middle East countries, mostly Saudi Arabia, Iraq, Oman, Iran, and Kuwait. Rising prices from oil supply shocks wreaked havoc on U.S. economies in the past, and could provide a template for China going forward, which leads to the next data point impacting the marketplace: trade.

We admit that at the start of 2019 we were optimistically forecasting that a trade agreement with China would be forthcoming by the middle of the year. Today, the only thing that has become certain about any trade negotiations with China is the uncertainty of President Trump’s Twitter tweets regarding increasing or decreasing tariffs that vary day to day.

Although China celebrated its 70th anniversary of the founding of the People’s Republic of China on October 1st, with strong words from President Xi Jinping about the strength of their country, the reality is China is struggling on multiple fronts. We continue to expect some type of resolution to the current trade dispute between the U.S. and China, with a good probability of reaching a deal in the next six months. However, after the news headlines announce the deal, the tugs and pulls between China and the United States will likely continue for years to come. Going back to our tree climbing analogy, any news of a trade resolution will give the market a strong limb to grab, potentially propelling the markets to new record highs.

The third data point that continues to influence the market is monetary policy throughout the world. During the 3rd quarter, 16 global central banks lowered interest rates. With more than $15 trillion dollars of worldwide debt currently yielding negative interest rates, investors continue to gravitate towards equities. In the U.S., rates are likely going lower. With the U.S. Manufacturing Purchasing Managers Index from the Institute for Supply Management coming in at 47.8% in September (the lowest reading since June 2009), this marked the second consecutive month of contraction — any figure below 50% signals a contraction. This confirms the concern that Federal Reserve Chairman Powell had during his September press conference, after lowering short-term rates by a quarter of a percent to a range of 1.75% to 2.0%, its second cut this year. We aren’t convinced that additional rate cuts will have much effect to address anxieties over trade uncertainty and delayed capital spending by corporations, but we wouldn’t be surprised if the Fed were to cut rates one more time before year end. While there are other factors influencing market volatility, we believe a resolution to the trade dispute between China and the United States would be the biggest development to help buoy the markets higher.

Since the founding of Kornitzer Capital Management in 1989 and Buffalo Funds in 1994, we have diligently focused on investment management based on in-depth, fundamental research and intimate knowledge of the companies in which we hold in our clients’ portfolios. Returning to the tree climbing analogy, we like to climb strong oak trees, which provide solid footing and hand holds for when the winds blows. Our investment strategy leads us to investments with the potential to weather the storm.