Q3 2018 – “The Robust U.S Economy Carries On”

For the past 10 years, world equity markets have been buoyed by unprecedented monetary policies adopted to kick start economies following the Global Financial Crisis of 2008. These “accommodating monetary” policies were intended to nudge economies to an inflection point where they achieved a self-sustaining upward growth trajectory. While most economies are seeing positive growth, albeit lower than expectations from early in the year, extraordinarily 25% of the world’s economies still have negative interest rates. Moreover, major central banks, with the exception of the U.S. Federal Reserve (the “Fed”), are currently putting $500 billion a month into the global financial system — hardly a backdrop that establishes confidence in a self-sustaining position for most of the world’s economies.

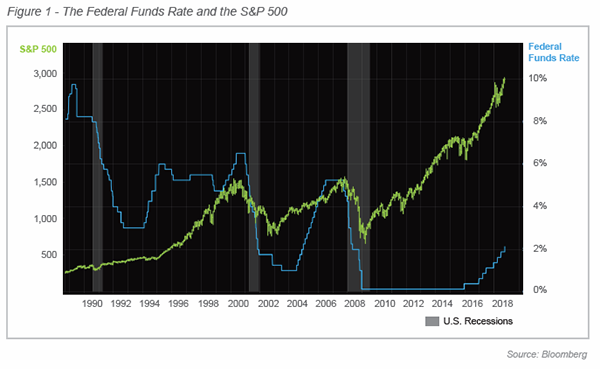

The Fed’s confidence in the robustness of the U.S. economy stands out from the world on multiple fronts. At its September meeting, the Fed continued towards its goal of “normalizing” interest rates by increasing the short-term Federal Funds rate to a range of 2.0% to 2.25%, a move which had been widely anticipated. This action marked the first time since 2008 that its benchmark rate hit 2.0% and surpassed the Fed’s measure of inflation. As illustrated in Figure 1 below, the accommodating policies keeping interest rates low and the quantitative easing (QE) the Fed has employed over the past decade, have been bullish for the U.S. stock market.

Fed guidance is for one more rate hike in 2018 (December), three in 2019, and one in 2020. Assuming all increases will be in 0.25% increments, the Fed Funds Rate would be between 3.25% to 3.5% by 2020, which is lower than where rates were prior to 2000.

The challenge facing the Fed is getting back to a level to ensure it has the capacity to lower rates in the event of a recession. As observed in the shaded portions of the chart representing the three recessions of the past 30 years, the subsequent lowering of the Fed Funds Rate was used to stabilize the economy. Notice that all recessions shown tend to follow a period of Fed Funds Rate tightening (rising rates). Therefore, the current challenge for the Fed is raising rates to a level that slows the economy to a sustained growth rate without tipping it into recession.

Additionally, the Fed has been attempting to “normalize” monetary policy by reducing its balance sheet by $40 billion a month and is expected to increase that reduction to $50 billion a month starting this October. The U.S. is the farthest along in normalizing its monetary policies, and most countries have not even started. However, the previously mentioned $500 billion per month that is being injected into the global financial system by major central banks outside the U.S. is expected to cease entirely by early next year.

Though Europe’s economic growth for this year and next has been lowered from earlier expectations, the European Central Bank (ECB) has committed to pressing ahead to phase out its $2.9 trillion bond buying program by the end of the year. The ECB expects to hold its benchmark interest rate at the record low of minus 0.4% at least through the summer of 2019.

March 29, 2019 marks the official date that the United Kingdom is set to leave the European Union, but there is no finalized withdrawal plan in place. If there is no deal by January 21, 2019, the British government must make a statement within five days on what the United Kingdom plans to do, according to the European Union (Withdrawal) Act of 2018.

Europe’s uncertainty heading into 2019 and the ongoing volley of tariffs and trade disputes could impact the Fed’s estimated trajectory of the U.S. economy. Although the tension between the U.S. and China continues, bilateral trade agreements are being completed with other countries.

Regardless of tariffs, it is unwise to underestimate American business ingenuity in resolving how to rectify roadblocks and optimize a solution to a problem. While certain industries, such as agriculture, could have significant difficulty recovering potential lost markets, most of Corporate America should be able to find working solutions within several years, if not sooner, if a prolonged trade dispute materializes. Unfortunately, consumers may see higher prices on certain items in the short-run, but given the strength in the economy, consumers are positioned relatively well.

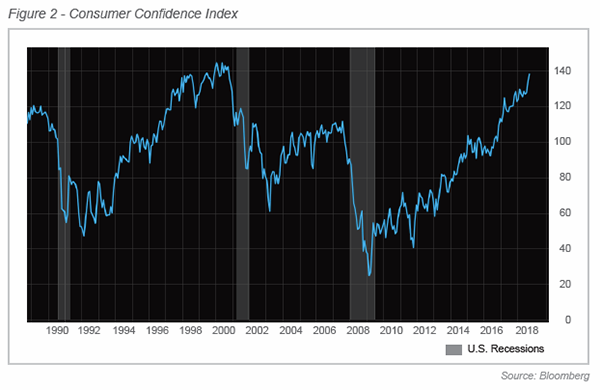

With the low unemployment rate, the U.S. stock market at all-time highs, and wages finally starting to show some increase, the average consumer feels good. This positive sentiment is measured by the Consumer Confidence Index, which hit an 18-year high in September, as illustrated in Figure 2. With the holiday season quickly approaching, this is a positive indicator for consumer spending and could help the markets finish the year strong.

According to the Fed, the economy should continue to support consumer sentiment. Economic output is growing more than 50% faster than the Fed forecast a year ago, wages are accelerating, and labor markets are the strongest they’ve been in at least a generation.

Capital investment is strengthening and productivity is starting to show some improvement. Stock price valuations are high, although many traditional value stocks have failed to participate in the bull rally to the same extent as growth stocks. Credit is cheap and widely available, and inflation is running at or near the Fed’s target of 2.0%.

The disparity between growth stocks and value stocks is perhaps the most glaring factor that could impact investors’ portfolio performance over the next 18 months. The bull market of almost 10 years has not been as favorable to those investors positioned conservatively with bonds or stocks. With low interest rates, corporations have been able to borrow a significant amount of capital to fuel growth opportunities and return cash to shareholders in the form of stock buybacks and dividends. As interest rates ratchet up, investors could gravitate to more reasonably-valued investments and not seek risky assets for growth.

Wall Street analysts have a rosy picture of corporate profits over the next 3 to 5 years, forecasting earnings to increase at an annual rate of 16.5%. We view this estimate as too optimistic, and if expensive stocks that are priced at “beyond perfection” valuations prove unable to report better-than-expected earnings, the market will likely see a dramatic increase in volatility. While this could hurt the high-flying growth stocks, there are a number of investments with more reasonable valuations that could benefit from a rotation of capital. Value investors should be well-positioned in a rising interest rate environment, as low rates have favored riskier assets (growth stocks) over the past several years. That performance disparity will start to tighten if value stocks perform better than growth.

As U.S. companies celebrate the anniversary of the tax reform of late 2017 and the increased earnings growth it brought, there is a significant wildcard that could help the market continue to reach new highs, and that is any significant resolution in the trade spat with China. If that gets resolved, we expect this market to continue its upward trajectory.