Q2 2018 – “Bitcoin – A Global Currency or a Speculative Bubble?”

Despite vast publicity in the media, very few people really understand Bitcoin. In this letter we will attempt to explain Bitcoin in simple, nontechnical terms. Also, we will explain why we think current Bitcoin market investors are riding a speculative wave that could soon collapse.

First, Bitcoin is not an actual coin as you see in some photographs and depictions in articles you may read. A Bitcoin is a digital token, with no physical presence, and no backing by any country’s central bank or government. Bitcoin can be sent electronically from one Bitcoin owner to another, anywhere in the world. A transaction takes place when a transfer of funds is initiated between the Bitcoin addresses of the sender and recipient. Addresses are heavily encrypted making the transactions anonymous.

Unlike centralized payment networks such as Visa or PayPal, which solely keep track of their users’ transactions and balances, the Bitcoin payment network is decentralized. All Bitcoin digital tokens are stored, moved and transactions are simultaneously verified across a massive (some 10,000) network of connected computers. The record keepers (known as miners) operating these computers continuously and independently update the chain of Bitcoin ownership. Each miner shares with all others something akin to a digital accounting ledger for all Bitcoin at that time. This system is known as Blockchain.

How is Bitcoin created? New Bitcoin is created as miners are paid in Bitcoin for their computer costs and services. The amount of Bitcoin growth per year is limited and pre-determined by the founder’s original design that there would be no more than 21 million total Bitcoin in circulation (some 17 million currently outstanding). Similar to the way the Federal Reserve prints new dollars out of thin air, new Bitcoin are also created artificially and distributed to miners via a speed and accuracy based lottery system (computer based) over time.

How do Bitcoins work? Bitcoins are essentially like having money stored in the cloud. This digital money is stored in wallets and you access the rights to them when you exchange Bitcoin addresses (see above) with vendors, individuals etc. Bitcoins can be purchased and sold online using a credit card from companies such as Coinbase.

In summary, the often written advantages of Bitcoin as a possible global currency include 1) the anonymity of transactions, 2) the speed and potential lower cost of transactions, 3) its global reach, and 4) the diversity and transparency of its Blockchain payment system.

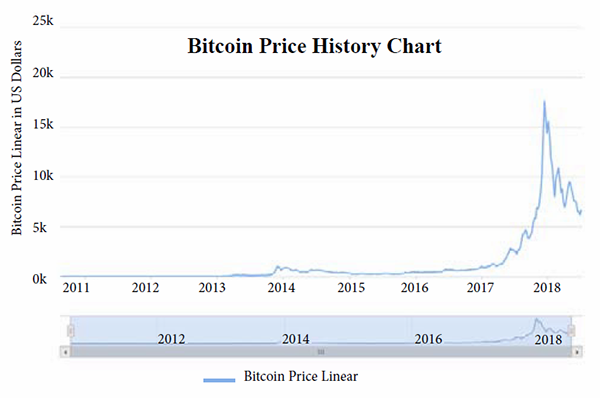

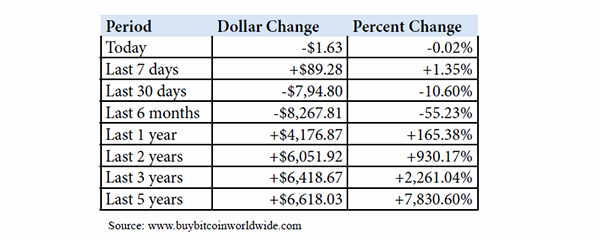

Now let’s discuss the negatives and potential downfalls of Bitcoin, which we think are numerous relative to the US dollar. In our opinion some of the limiting factors to Bitcoin becoming a legitimate global currency include: 1) lack of market depth and liquidity, 2) lack of price stability (see graph), 3) numerous countries do not accept Bitcoin as a legal currency, 4) the majority of Bitcoin transaction value has gone toward speculative trading rather than commerce, 5) in a growing world economy it is impractical to cap the amount of global currency outstanding, and 6) in a security conscious world it makes no sense to favor a currency which can be moved across the globe anonymously.

In our view the ability of Bitcoin to unseat the US dollar as the world’s dominant currency is near zero in the medium term. Current statistics speak to the high degree of confidence in US dollar value and stability. Around $580 billion of US bills are used outside the country. That’s 65% of all dollars. More than 1/3 of global GDP comes from countries that peg their currencies to the dollar. More than 85% of forex trading involves the US dollar. 39% of the world’s debt is issued in US dollars. Finally, 64% of all Central Bank foreign exchange holdings are in US dollars.

Perhaps most important is the perceived value of the guarantee and backing of the dollar by the US government. Although the US completely severed its ties to the gold standard in the early 1970s, the US dollar is still backed by the full faith and credit guarantee of the US government. For many countries this would mean very little but US GDP has grown 44 out of the past 50 years. The S&P 500 Index has grown at a 10% per year pace over the same period. Tax revenue and government owned assets have grown substantially. Thus, the government backing is recognized globally as having real value.

Unlike the dollar and other country-backed currencies, Bitcoin has no government or asset backing whatsoever. While we acknowledge some of Bitcoin’s positives, we view there are far more negatives. So what is driving the price appreciation? We view it as a temporary situation driven by pure speculation. New buyers are entering the market simply because it is going up. This situation, like other bubbles, is not sustainable because Bitcoin has no real underlying value. As that reality sinks in traders are likely to take their losses and switch to other trading vehicles. If trading volume shrinks materially, the price of Bitcoin could drop to near zero.