Q1 2018 – “Market Volatility Returns”

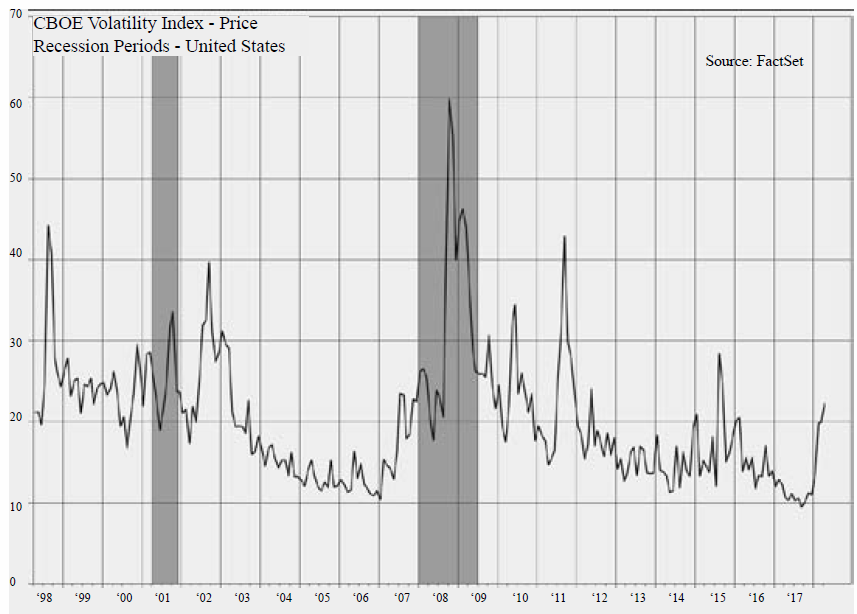

The U.S. stock market started off in January with a bang, rallying to new records daily. However, in February volatility was reintroduced to investors at a level that has not been seen since 2015, as measured by the CBOE Volatility Index (VIX). After nearly nine years since the great financial crisis of 2008, the jitteriness of the aging bull market seemed to be looking for any excuse for a sell off, and the talk of a potential tariff war was enough to send the market down, with wide intra-day swings. With all of the excitement, the S&P 500 Index declined .8% during the quarter, which gave the impression of the market’s bark being worse than its bite. Nonetheless, this was the first time in the past ten quarters that the S&P 500 Index was negative for the quarter.

Three major cross currents are impacting the market currently: the rise in interest rates, 2017 tax reform, and the trade tariff talk. As was widely anticipated, The Federal Reserve (the Fed) raised their benchmark lending rate by a quarter of a percentage point in March (to a benchmark interest range of 1.5 – 1.75%). Additionally, the Fed indicated that they expect to raise rates another two times this year and then three times in 2019 (up from two previously) due to the strengthened economic outlook. Other short-term benchmark lending rates (such as LIBOR and Commercial Paper) have gone up more than half of a percentage point, due to anticipation of further interest rate increases and the beginning of dollar repatriation activity by U.S. companies due to the changes in the tax law.

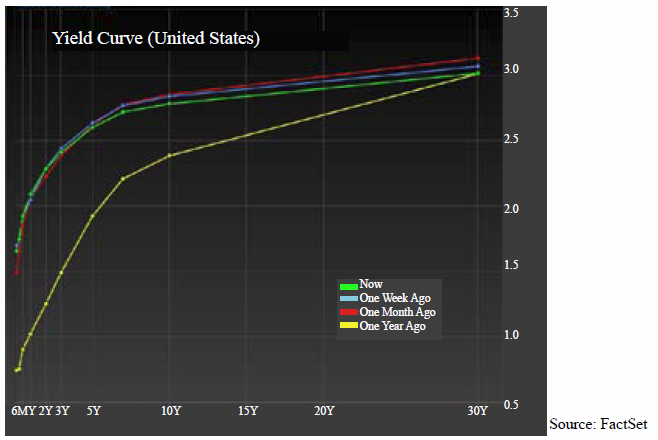

The benchmark 10-year Treasury note experienced a slight increase in its yield, as inflation expectations remain modest, ending March 31st at 2.74% compared to 2.56% and 2.43% at the end of 2016 and 2017, respectively. With most of the rest of the world continuing to stay highly accommodative with their monetary policies (quantitative easing programs artificially keeping interest rates low in their economies), it helps put a ceiling on interest rates as U.S. interest rates look relatively attractive compared to the yield on other nation’s sovereign bonds. During February, foreign investors bought the largest amount of Treasury notes and bonds through U.S. government debt auctions since May 2016.

The number of Treasuries held for foreign central banks by the Federal Reserve has climbed to a record $3.1 trillion in March and is up 7% from a year ago. As the Fed continues to raise its benchmark rate during the year, there will likely be upward pressure on longer-term rates. Nonetheless, as the yield curve chart illustrates below, as short-term rates have increased, the longer term rates on the yield curve have flattened, as investors are either anticipating that the economy will not be as robust (rise in the short rates will lead to a recession), inflation remains under control, a trade war that could hinder economic growth, foreign quantitative easing will continue beyond the fall, a safety haven has occurred given recent market volatility, or a combination of all the above.

U.S. companies communicated on their year-end calls the benefit of the recent tax reform with increased profitability as a result of the permanent reduction of the corporate tax rate from 35% to 21%, leading to a positive earnings growth outlook for 2018. As the dust settled, investors were left contemplating whether lowering the corporate tax rate would have more than a one-time positive impact, or just a positive impact on 2018 earnings growth. This uncertainty could perhaps be some of the cause for the stocks retreating in February, but we believe that the corporate tax reform will put U.S. companies in a better competitive position within the global economy well into the future.

From a 30,000 foot view, corporate tax reform was the first step in positioning Corporate America on a level playing field in the global marketplace from a tax perspective. Naturally, the next step would be to position Corporate America on a more level playing field in the global markets from a trade perspective, and that is where the recent tariff talks come into play. Before commenting on potential trade war scenarios, it is best to understand the current instigator of the trade talks, President Trump, who is unquestionably a businessman before a politician, and as so his strength is in negotiating deals, not diplomacy.

In Negotiating 101, successful negotiations start by knowing what leverage can be brought to the table, and for President Trump, the United States economy (the largest in the world) gives him the upper hand in negotiations. When compared to the second largest economy, China, which claimed a gross domestic product (GDP) of $12.8 trillion in 2017, the United States’ GDP topped $19.3 trillion in the same year. Countries that have a high percentage of their GDP derived from exports tend to be more negatively impacted by trade tariffs. According to the 2016 World Bank figures, global exports made up 29% of global GDP. For China, 20% of its GDP was dependent on exports. By comparison, exports make up 12% of the U.S. GDP.

For years the media has reported the wide trade imbalances the U.S. has with the rest of the world, a problem that comes naturally to the largest importing economy in the world. In 2016, China’s exports to the U.S. were worth $386 billion, while its imports from the U.S. were worth only $135 billion. In a trade war, this trade surplus would become a weakness for China and something that both sides should understand. China derives about 3% of its GDP from exports to the United States, while the United States derives around 0.5% of its GDP from exports to China.

While a return to a 1930’s style global trade is undesirable and would leave no economy unscathed, we believe so far, that the tariff talk is nothing other than utilizing the world’s biggest economy as leverage to lower trade barriers with other countries. The effective start date for the tariffs have not been announced from both the United States and China. Currently, free trade is a misnomer in many industries, and many countries, including the U.S., which impose tariffs on certain imported products already. The theft of intellectual property and trade secrets in China is no secret among the business and investment communities throughout the world, where knock-offs of the world’s leading brands can be commonly found on the streets of China or mandatory technology transfers are required by companies wishing to do business in China. Any trade reform with China will be positive for Corporate America, and we believe that successful negotiations will be the result of the recent verbal volley back and forth between multiple trade partners.

We believe this short-term volatility is just the beginning and could intensify as other central banks reduce their easy money policies and return to a more normalized environment. The last time the S&P 500 was up over 5% in the month of January and finished negative for the quarter was in 1980. While there were different factors impacting the market at that time, such as double-digit inflation, mortgage rates in the high teens, etc., it was a time of great uncertainty, and financial markets are particularly adverse to uncertainty. Regardless, the market finished up 31.7% for that year. The object lesson here is not to overreact to the short-term events, particularly with the sensationalism of the current media coverage jumping from one crisis to the next but remain focused on long-term financial goals. The current economy is in a much better position than the doomsayers would lead you to believe.