Q3 2016 – “A Saver’s Dilemma”

The third quarter ended with the stock market higher by 3.85% as measured by the S&P 500 Index. The Federal Reserve (Fed) maintained its target range for the federal funds rate at ¼ to ½ percent. When the Fed increased short-term interest rates last December (for the first time in nearly a decade), market watchers, including ourselves, described the likely slow and well calculated trajectory of future rate increases as “glacial”. Glaciers are perceived as slow moving, but recent observations from Greenland in 2012 recorded that country’s largest glacier moving at about 150 feet per day. To put that into perspective, the Fed’s target rate is at the same point as last December while Greenland’s glacier is nearly eight miles down the road. Perhaps finding a slower moving analogy to describe Fed policy would be more appropriate.

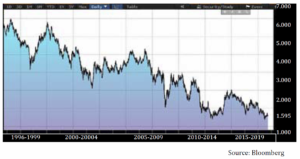

While there were no changes to interest rates in the period, the official Federal Open Market Committee (FOMC) statement read that “the case for an increase in the federal funds rate has strengthened,” validating the street’s expectation that a rate increase could be coming this December. Regardless, we don’t anticipate a “normalization” of interest rates to anything remotely close to historical norms anytime soon. From 1990 to 2007 the 10-year Treasury note’s yield averaged 5.8%. Today it’s below 2%. For investors relying on fixed income investments, finding yields reflective of normal based on the past two decades is a difficult proposition without reaching way out on the risk spectrum, see graph below.

Last year the Fed projected that rate policy increases throughout 2016 would result in the fed funds interest rate reaching a target range of 1.25% to 1.50% by year-end. As we now know that is nearly 100 basis points above the Fed’s current policy range. We believe rates don’t have a realistic chance of reaching those levels until the end of 2017, or even 2018, as the trajectory of rate increases continues to flatten from last year’s guidance. Multiple factors are causing the Fed’s cautious stance but the lack of global growth and wage inflation seem to be the primary concerns at this time. In March, Federal Chair Reserve Janet Yellen stated that “a lower level of unemployment might be needed to fully eliminate slack in the labor market, drive faster wage growth, and return inflation to our 2% objective.”

As mentioned in our previous newsletters, the unemployment rate is a key indicator of the health of our economy, and the “slack in the labor market” to which Yellen is referring is the measure of the quantity of unemployed resources. With less “slack” there is a higher probability that wage growth will materialize as employers must pay more to retain and hire employees as a result of the tighter labor market. As wages increase, consumers are likely to spend more, and since consumer consumption drives 70% of the nation’s Gross Domestic Product (GDP), an increase in wage inflation could provide a tailwind to the economy and offer the Fed with the necessary improvement in economic data to justify moving towards a “normalization” of interest rates.

Although the Fed has not quantified its desired wage growth target, we can analyze data back to 1990 and calculate that when the unemployment rate falls to approximately 5%, wages typically grow about 4.2% annually. For comparison, wages have increased by only about 2.6% over the past 12 months ending September 30. The good news is that the 2.6% annual wage inflation rate ending September is greater than the 2.4% annual increase reported at the end of August. Whether or not this is the catalyst to get inflation to the central bank’s 2% goal, only time will tell. Taking everything into consideration we believe that it shouldn’t be a surprise to investors if the Fed raises rates by 25 basis points in December.

In spite of the low inflation measured by the Fed, there are many expenses impacting consumers in real ways that often leave them wishing that sub 2% inflation was a true reflection of their daily household expenses. For example, tuition for an undergraduate degree from one of Kansas’ state universities has averaged annual increases of 7.55% since 1989. It is not surprising that college students thronged to Bernie Sanders during the Democratic primary race out of frustrations over the cost of higher education.

Next, healthcare expenses which consumes nearly 17.4% of the GDP, is another area that has seen significant increases in real costs to households and businesses over the past several years. Annual healthcare insurance premium increases are being reported in the 5% to 6% range for 2017 renewals. It’s worth noting that there is some difficulty in accessing the true increase in healthcare expenses, as consumers opt for larger deductibles and copays to dampen the annual increase in premium costs. According to a recent Kaiser Family Foundation study, a nonpartisan think tank addressing health policy issues, the average family’s healthcare insurance premiums increased 3% between 2015 and 2016, to $18,412 annually. In talking with family, friends, and neighbors, we are all aware that health care costs are a significant expense households absorb today.

Given this backdrop where do we see the investment opportunities going forward, you might ask? Looking across all the major asset classes, we favor equities as the primary means of growth. We believe there is potential for capital market appreciation but we expect it to be accompanied by an increase in volatility. Increased choppiness is not unusual for an extended bull market and we are seven plus years into the current bull period. Looking back, we believe the market is similarly positioned to where it was at this time last year with the additional uncertainty produced by the upcoming Presidential election which may add to volatility. On a valuation basis, in terms of is the market cheap or expensive, we don’t see it as overly priced based on historical measures. The S&P 500 Index is trading at a Price to Earnings (P/E) multiple of 16.8 as of September 30th, which is fairly reasonable compared to the 25-year average of 15.9.

In our view there are pockets of the market that are expensive, but those always exist regardless of where we are in the cycle. Also supporting our case for stocks is historical data that has associated rising stock prices with rising rates when yields, as measured by the 10-year Treasury note, are below 5%. Once yields start to trend above 5%, investors become more attracted to locking in those yields and capital typically flows out of equities, causing a negative relationship between yield movements and stock returns. Recall that the yield on the 10-year note is currently less than 2% and well short of this 5% inflection rate.

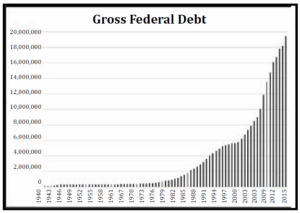

Income-focused investors have had to change traditional investment strategies by incorporating more dividend paying equities into their portfolios as the supply of bonds has decreased. Fixed income yields have been influenced by the actions of foreign central banks and their quantitative easing and bond purchases have pushed down long-term yields around the globe. As of mid-September, Barron’s reported that there were approximately $12.6 trillion of global bonds yielding less than zero. This is a significant increase over the $8.7 trillion in negative yielding bonds as of June 30th. To put this number into perspective, the total US Federal debt outstanding at the end of the quarter was approximately $19.3 trillion. Imagine being one of the 500 million people living in a country whose central bank has adopted a negative interest rate policy, where the borrowers get paid and the savers penalized.

Negative interest rate polices have forced investors throughout the world to seek yield abroad, and that has resulted in capital flowing into the United States contributing to our low rates. Only a coordinated plan of rate increases between the world’s central banks will result in more normalized interest rate levels globally. However, the increase in debt throughout the world to record levels ($152 trillion as reported by the International Monetary Fund, a number more than two times the size of the global economy), makes the likelihood of rates increasing substantially slim.

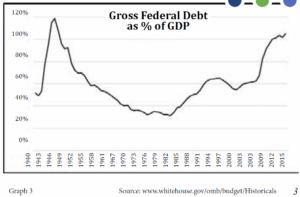

Growing federal deficits and a rising debt-to-GDP ratio in the US will make fiscal policies designed to stimulate and invigorate the economy, such as tax reform or increased infrastructure investment, a challenge. The Congressional Budget Office (CBO) recently quantified the magnitude of policy changes needed to meet various goals for the Federal Debt. Assuming that lawmakers set out to ensure that federal debt held by the public (currently 75% of GDP) remains unchanged by 2046 would require cutting noninterest spending or raising revenues each year beginning in 2017 by 1.7% of GDP, or $1,000 per person.

The graphs below illustrate the significant increase in US treasury debt over the past few decades. Regardless of who wins the Presidential election in the US, there will likely be a push for fiscal stimulus as the new administration will want to put their thumbprint onto the economy. With the national debt levels presented above, it will be challenging from a budget perspective to do so without some type of give and take. The United States is in a difficult position in terms of getting interest rates back to what most of us perceive as normal. We may very well be at a “new normal”, and investors will have to bear more risk in achieving yield as a source of income.

At Kornitzer Capital, we have a seasoned high yield investment team that is constantly seeking prudent opportunities for attractive yield in higher quality non-investment grade corporate debt, convertible bonds, and dividend growth stocks. Over the past decade, equities have become a larger mix of income producing portfolios, and will likely remain so in the foreseeable future, until we believe yields and the supply of bonds reach a more desirable level.

Even the Fed itself might be moving towards other investments. Speaking by video at a Kansas City Fed conference during the last week of September, Janet Yellen said that the Fed, as has happened with some overseas central banks, might find itself hitting a ceiling on the amount of U.S. government bonds it could purchase. In that case, the Fed, she stated, would have to move on to other assets such as corporate bonds and stocks. While we wouldn’t expect the Fed to implement this activity in the short-term, the mere mentioning of it as a possibility is worth noting.

In summary, expect an increase in volatility that will provide opportunities. Any short-term dislocation by world events should be short-lived as this market continues to have room to grow. As always, we greatly appreciate your continued support and will continue to work diligently to be good stewards of your capital in meeting your investment needs.