Q1 2017 – “Trump Trade Fade”

The first quarter ended with the stock market completing its eighth year of the current bull market, with the Standard and Poor’s 500 Index advancing 6.07%, marking the sixth quarter in a row the index closed in positive territory. Not only was the past quarter one of the least volatile quarters in some 50 years, the sectors that performed well were the stocks that lagged during the fourth quarter last year, as the “Trump Trade” faded. As long as the world economy continues to strengthen, inflation inches upward in a controlled manner, and Congress makes headway on U.S. tax reform and an infrastructure investment bill, we anticipate a favorable environment for investors throughout the world. We believe the market is poised to continue to produce positive returns this year as U.S. companies are also expected to report the strongest quarterly earnings in years for the first quarter.

During March, the Federal Reserve raised the federal funds rate by 25 basis points to a range of 0.75% to 1.00%. This move was widely anticipated by the market, and as the economy continues to remain healthy, another two rate increases are expected by year-end. Assuming that there are two additional 25 basis point increases before year-end, the federal funds rate would range between 1.25% – 1.50%. This would mark the first time since 2008 that the federal funds rate has risen above 1.00%. While there is a chance that the Fed could raise rates at a faster pace than three increases this year, most believe that a gradual path of rate increases is most likely.

Contrary to the visibility provided to its plan of raising rates through the fed funds, the Federal Reserve has been much more guarded with the plan to shrink their balance sheet. Before the financial crisis of 2007 – 2008, their balance sheet was less than $1 trillion, but through multiple quantitative easing programs, it has ballooned to a $4.5 trillion portfolio of treasury and mortgage securities. During its March policy meeting, the Federal Reserve officials discussed that they would likely begin to shrink the portfolio later this year. The most likely scenario in reducing their balance sheet would be to reinvest only a portion of the maturing principal amount instead of reinvesting the full amount into similar securities. We believe their balance sheet plan will be a measured and cautious reduction over time in conjunction with walking the tightrope of maintaining a systematic approach in returning interest rates to a more “normalized” level to increase the optionality for the Fed to stimulate a slowing economy during the next down-cycle.

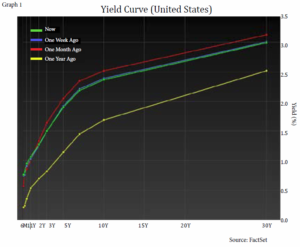

Equity markets outside of the U.S. also produced a strong showing during the quarter as global economic data has been consistently improving so far this year. In December, the European Central Bank announced that it would dial back its monthly bond buying program in April 2017 from 80 billion euros ($86 billion U.S.) a month to 60 billion euros a month until at least December 2017. And with the tapering of the buying program in sight, underlying sovereign interest rates are starting to increase. For example, the yield on Germany’s 10-year government bond more than doubled, rising 18 basis points year to date to 0.39%. But even with the doubling of the yield on the German Bund, foreign buyers continue to struggle to find attractive absolute yield within the Eurozone. In fact, strong foreign investment in U.S. Treasury’s is keeping a lid on government bond yields and while the U.S. Treasury yield curve is higher than last year, it is down from levels seen last month (see yield curve below). The consensus expectation is that the yield on the 10-year Treasury will be 3.00% to 3.50% by year-end (compared to its current yield of 2.37%) but that is dependent on the economy continuing to be strong, and assumes the Fed will continue to follow its plan of two additional rate increases before year-end.

While optimism is prevalent there are always unforeseen factors that could adversely affect the market. Geopolitical risks seem to become more elevated by the week and naturally investors’ appetite for entering into another conflict throughout the world is low. Market participants would rather cheer on legislation that could help spur on economic growth. But even on that front, despite having a majority in both the House of Representatives and Senate (as well as occupying the White House), the Republicans have so far proven slow to govern, with a health care reform proposal stalling in the House of Representatives. The inability to even bring the Affordable Healthcare Act to a vote in the House, after previously voting to repeal Obamacare more than 60 times in prior sessions, leads to serious questions as to whether President Trump’s pro-growth agenda will be able to get off the ground.

With the April congressional recess now at hand, Congress will have just three months to address tax reform and an infrastructure plan until another full month recess in August. It has been more than 35 years since any major tax reform has occurred in America, so it will be unlikely that a change will take place within a three-month period, but any increased visibility on changes being discussed could help investors determine the potential benefit to the economy and businesses. A significant portion of earnings growth since the Great Recession has been driven by operational efficiencies (cost cutting), but a moderate amount of inflation and positive tax reform could help propel corporate earnings to the next leg of earnings growth. Regardless, any revisions to tax and regulatory policies should reinvigorate economic growth. An additional jolt to the economy could be any move on President Trump’s infrastructure plan, which while lagging details, has been described by one of the President’s Cabinet members as an investment program valued at $1 trillion over 10 years focusing on multiple sectors outside of transportation infrastructure, including energy, water and potentially broadband and veterans hospitals.

In closing, we mention another factor that could likely influence volatility into the marketplace which is the growth of passive investment vehicles. Over the past decade, passive index strategies have become a larger portion of the investment landscape. There are roughly 2,000 U.S.-listed ETFs in existence, with roughly 20 ETFs accounting for more than a third of all ETF assets in broad market indexes, such as the S&P 500. As capital flows into and out of these funds, there is indiscriminate selling or buying as the funds true up the positions to match their respective benchmark by the end of the trading day. For instance, after President Trump’s State of the Union speech on February 28th, during the following day, nearly $8.2 billion poured into the SPDR S&P 500 (SPY), the world’s largest ETF. Active managers have the luxury of making real time allocation decisions to accommodate the net flows into their funds, but ETFs must invest their portfolio by the end of the market close to mirror its respective index, regardless of valuation considerations or liquidity of the underlying securities. With flows of this magnitude for the SPDR ETF, it would represent nearly 9.4% of the average daily volume for the top 100 thinly traded securities within the S&P 500, with some of the securities accounting for mid-teens to 20% of the average daily volume.

A recent financial publication article that noted that the stocks whose daily trading volumes were most affected by ETF flows also performed the best, concluding that investors should not expect significant outflows to take stocks down. We would have a different assessment given the basic rule of supply and demand and influences of the movement of capital and would caution investors to understand their exposure to the market, particularly in the latter stages of the economic cycle.